August Asset Class Performance

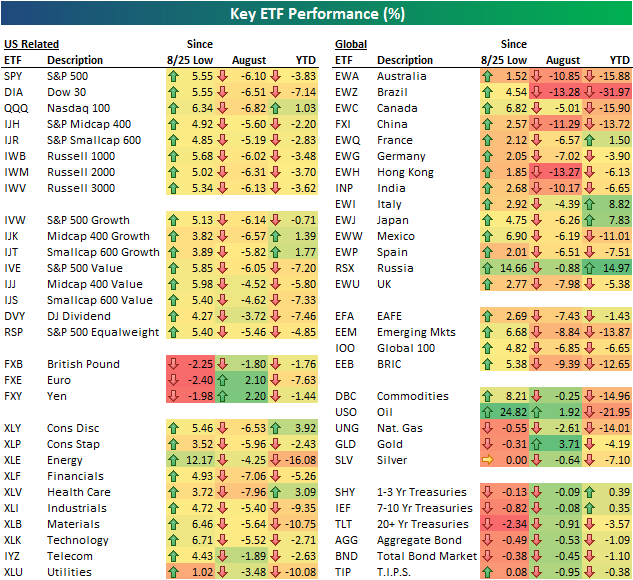

These numbers are set to be a lot different at the open this morning given that Dow futures are down 400 points, but below is a snapshot of asset class performance since the 8/25 low, for the full month of August, and year-to-date through August. As shown, U.S. equity ETFs were down 5-7% across the board in August, even after bouncing 5-6% since August 25th. Country ETFs like Australia (EWA), Brazil (EWZ), China (FXI), Hong Kong (EWH) and India (INP) were down 10%+ in August, while Russia (RSX) was surprisingly the best performer with a decline of just 88 basis points.

Commodity ETFs had a better August than stocks after the huge rally in crude oil that we saw over the final three trading days of the month. Treasury ETFs all finished modestly lower.

|